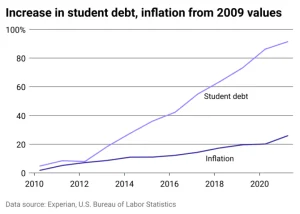

As high school seniors prepare for the next step in their education, many are faced with the daunting task of taking out student loans to finance their college education. With the rising costs of tuition, and living expenses growing faster every year, taking out loans has become one of the only ways for students to afford a higher education. Seniors must understand the loan process so they do not rush to make decisions that could potentially harden their futures. Here are some valuable tips and advice for seniors thinking about taking out loans.

Avoiding Loans

The first piece of advice about student loans is to avoid them altogether. Taking out loans should be the last option to finance your education. Before considering taking out loans students, should look for financial aid they do not need to pay back. This can come from family contributions, grants, and scholarships.

- Family Contributions – Understand what your family expects to contribute to your education now, so you can plan ahead and get a better idea of what you will be responsible for paying yourself.

- Grants – Many schools offer grant money based on financial need, this usually comes along with your acceptance letter. The Federal government also provides grants based on financial need that is provided after submitting the FAFSA Application.

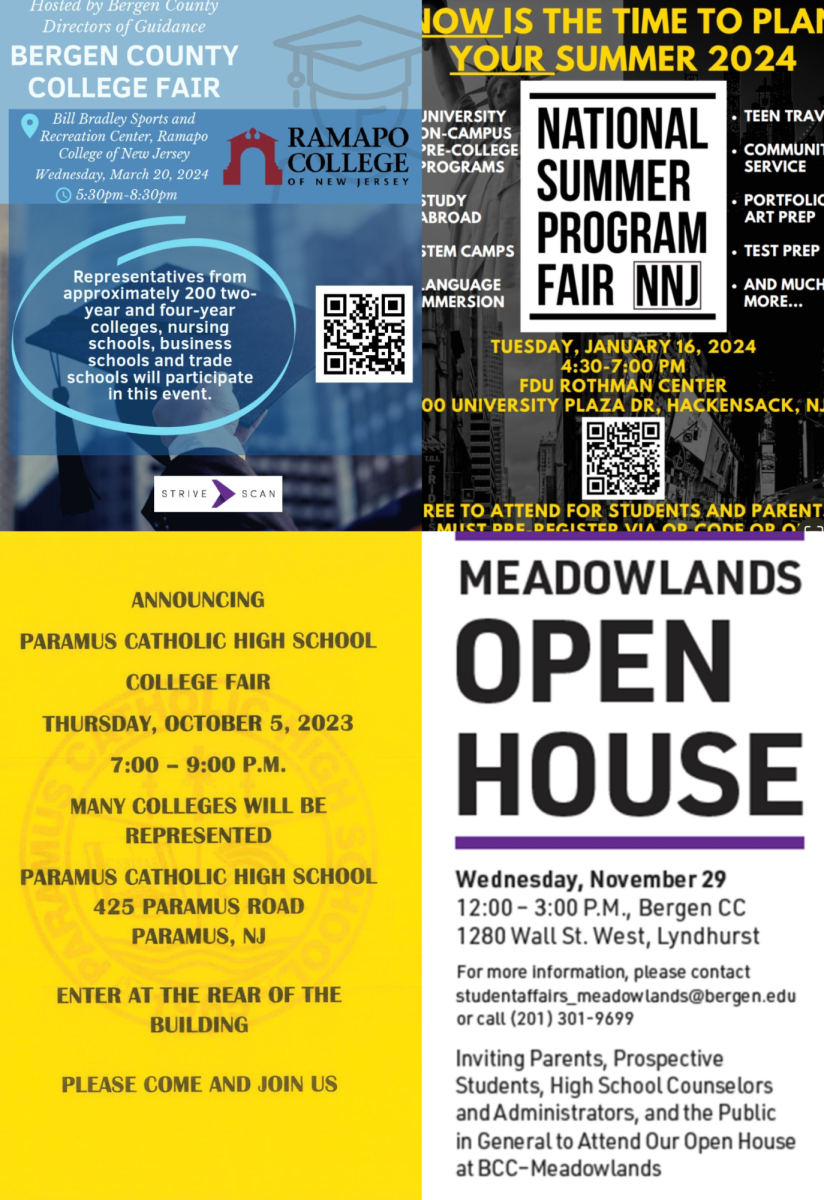

- Scholarships – Many scholarships are available based on academic achievements, extracurricular involvement, community service, and other criteria. Although time consuming, dedicating the time now to applying for scholarships can save you thousands of dollars down the line. Students can access local and national scholarship information on the Becton Website under the Financial Aid and Scholarships section, which includes information regarding FAFSA hot topics, helpful resources, financial aid info, college aid info, national/regional scholarships, and local scholarships. Students are also encouraged to do their own research to identify scholarships that align with their qualifications.

Types Of Loans

If after calculating the financial aid you still cannot afford tuition, you will likely need to take out loans to cover the remaining cost. When considering student loans, it’s important to understand the different types of loans available to you. Federal loans, such as Direct Subsidized and Unsubsidized Loans, are offered by the government and typically have lower interest rates and more flexible repayment options. They also come with borrower protections, such as deferment and forbearance options.

Private loans, on the other hand, are provided by banks, credit unions, and other financial institutions. While private loans may offer competitive interest rates, they often lack the benefits and protections associated with federal loans so it is generally recommended that you look for federal loans using private loans only as a last resort.

Borrow Only What You Need

One of the most crucial pieces of advice when taking out student loans is to borrow only what is necessary. It can be tempting to accept the full loan amount offered, especially because loan providers make it so accessible to do so. However, borrowing more than needed can lead to significant debt after graduation. Before accepting any loan offers, students should carefully calculate their expenses, and financial aid, then borrow only what is essential to cover these expenses.

Additionally, understanding the repayment terms and interest rates associated with student loans is crucial for long-term financial planning. Interest rates can significantly impact the total amount repaid over time. It’s crucial to research and compare interest rates offered by different lenders. As a general guideline, a realistic loan amount for a student should ideally not exceed their expected starting salary after graduation. This ensures the loan is manageable and can be repaid without significant financial burden.

Seeking Advice

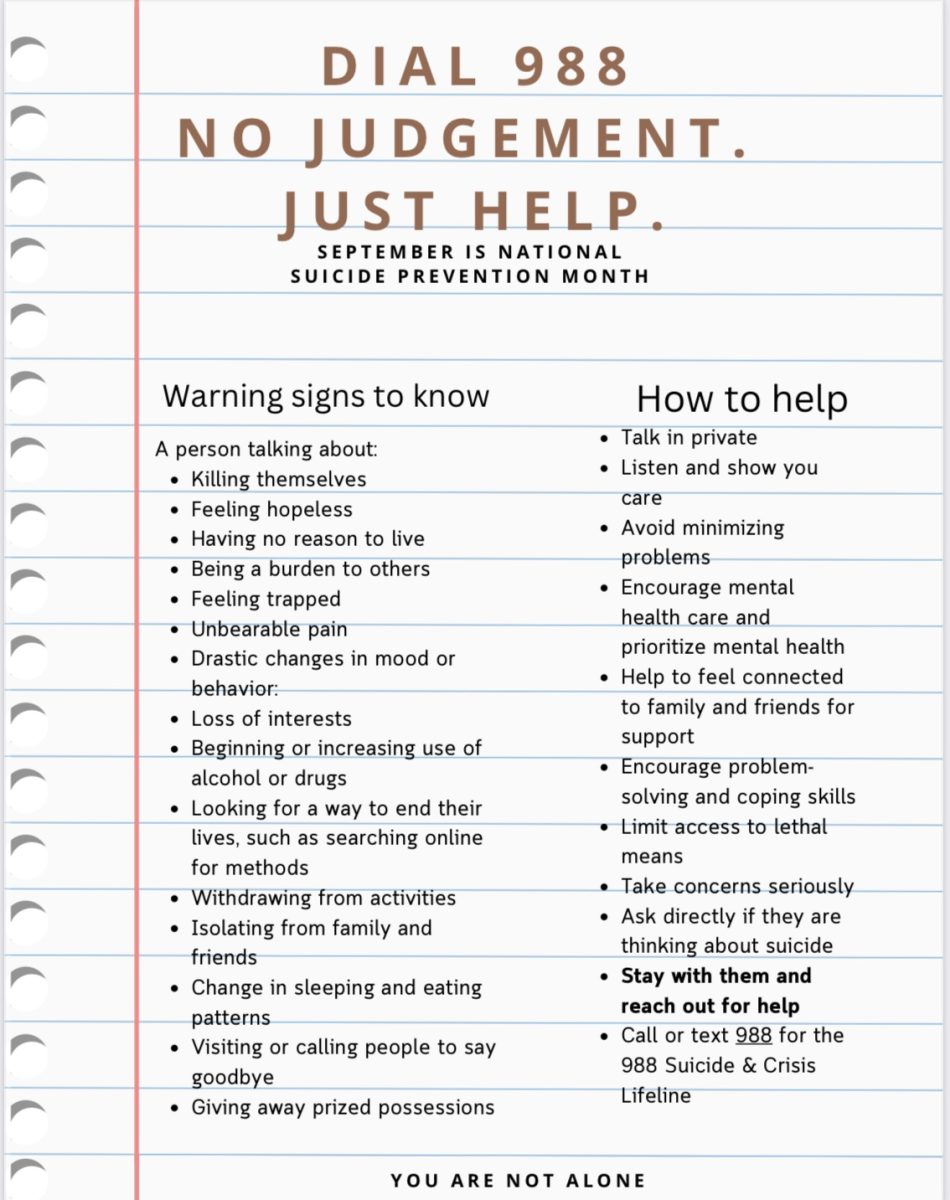

Making the most significant financial decisions of your life at 18 can be overwhelming, but fortunately, students can find assistance. Most colleges and universities offer Financial Aid counseling services to help students understand their options and make informed decisions. These professionals can provide personalized guidance, help students create a realistic budget, and explore alternative funding sources. In addition, students should discuss options with family, guidance counselors, and students who have similar experiences to make sure they are making the best choices for their future.

In conclusion, while student loans are unavoidable for some, seniors can take steps to minimize their debt. By exploring scholarships and grants, understanding the types of loans available, borrowing responsibly, and seeking expert advice, students can make informed decisions that set them up for a bright future.